Navigating the maze of auto glass business license requirements is critical first step to launching a legitimate and profitable venture. This isn’t just routine paperwork; it’s about legal compliance, customer trust, and eligibility for key insurance partnership. Our 2025 directory is designed to cut through the confusion, providing you with direct links to official state portals and a clear path through the complexity of state licensing regulations.

Whether you’re an experienced technician branching out on your own or a new entrepreneur entering the field, this guide covers everything from auto glass business startup costs to specific surety bond requirements and ADAS calibration certification. We’ve integrated real-world challenges discussed by shop owners on forums like Reddit and Quora, ensuring you get practical, actionable advice that goes beyond basic government checklists.

Why Auto Glass Licensing Matters

Proper licensing is more than a legal formality — it’s a signal of trust, safety, and professionalism. Licensed auto glass businesses can partner with insurance networks, perform ADAS calibration legally, and assure customers that repairs meet federal and state safety standards. Whether you operate a fixed shop or a mobile service, maintaining the correct business and contractor licensing protects your reputation, avoids costly fines, and builds long-term customer confidence.

Remember that licensing is just one part of the broader regulatory landscape, which includes federal safety standards, insurance rules, and consumer protection laws covered in our main auto glass compliance guide.

Understanding Auto Glass Business License & Permit Types

Before diving into state-specific applications, it’s crucial to understand the landscape of permits and certifications you might need. The requirements aren’t one-size-fits-all; they vary based on your business model, location, and the services you offer. Misunderstanding these categories is a common reason for application delays and rejections, so let’s clarify the key license types and their purposes.

- Business Licensing vs. Technician Certification: A business license (e.g., a general business operation license) allows your company to operate legally within a jurisdiction. In contrast, a technician certification, like those from the Auto Glass Safety Council (AGSC), validates an individual’s skill in windshield repair and installation. You might need both, but they are distinct. A common question from mechanics is, “Does my auto repair license cover windshield work?” The answer is often no, requiring a separate glazing contractor license or specific auto glass endorsement.

- Mobile Glass Service Permits vs. Physical Shop Licenses: Operating a mobile auto glass service introduces unique regulations. Some states, like Florida, issue a specific Mobile Glass Permit through FDACS. A critical point often raised on forums is that mobile operators may need business licenses in every city and county they work in, not just a single state permit.

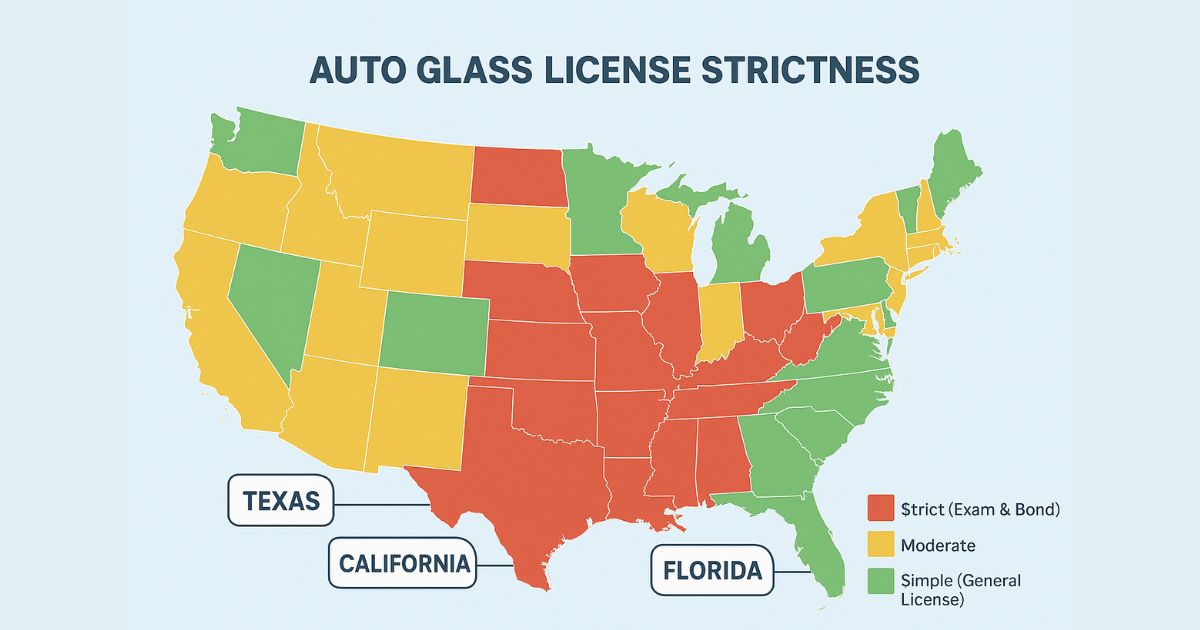

- Glazing Contractor Specialized Licenses: States like Texas and California classify auto glass work under a glazing contractor license. This is a specialized trade license that often requires proof of experience, passing an exam, and carrying a substantial surety bond.

- Environmental Compliance Certifications: Proper disposal of old windshields is regulated. You may need a specific environmental compliance certification for hazardous material handling, as laminated glass can be considered special waste.

To see how these license types play out in practice, consider a direct comparison of Florida vs Texas auto glass regulations. Florida’s system, through FDACS, focuses on a specific permit for mobile services, while Texas requires a full glazing contractor trade license with an exam.

This difference in approach is why industry professionals often classify states like Texas, California, and New York among the strictest states for auto glass businesses, due to their higher barriers to entry like exams and experience proofs. Conversely, some of the easiest states to start a glass business have no specific state-level glass license at all, requiring only a general business license at the city or county level.

How to Use This Directory for Maximum Efficiency

This directory is designed to be your central hub, saving you hours of frustrating searches across poorly designed government websites. We’ve consolidated the essential information for all 50 states into a single, easy-to-navigate resource. To get the most value, follow this quick guide on interpreting the data and applying it to your specific situation.

Start by locating your state in the main directory table. The “Governing Agency” column tells you exactly which state body to contact, while the “Direct Application Link” takes you straight to the source. Pay close attention to the “Notes” column, as it highlights critical, non-negotiable requirements like ADAS certification or bonds. We strongly recommend bookmarking this page not just for your initial application, but also for future license renewal and multi-state expansion planning. Remember, for mobile service regulations, you must also check city and county requirements beyond this state-level data.

Auto Glass Licensing: 50-State Business Directory (2025)

This table provides a snapshot of the auto glass license requirements by state. Use it as your starting point for understanding the governing bodies and associated costs. Always verify details directly via the provided application links, as regulations and fees can change.

| State | Governing Agency | Typical License/Permit Name | Official Source | Fees (Approx.) | Notes & Auto Glass Specifics |

| Alabama | AL Secretary of State | Business Entity Registration | AL SOS Website | $40 – $150 | No specific auto glass license; general business registration required. Check local city/county rules. |

| Alaska | AK Dept. of Commerce, Community, and Economic Development | General Business License | AK DCCED License | $50 – $250 | No specific glass license; state business license is mandatory for all entities. |

| Arizona | AZ Registrar of Contractors | Glazing (C-53) Contractor License | AZ ROC Website | $440 + Bond | Yes, a specific license is required. Surety bond and passing an exam are mandatory. |

| Arkansas | AR Contractors Licensing Board | Glazing Contractor License | AR Licensing Board | $250 | Yes, a specific license is required. Typically requires passing a trade exam. |

| California | CA Bureau of Automotive Repair | Automotive Repair Dealer License | CA BAR Website | $200 – $500 | Auto glass work is regulated under the general Automotive Repair Dealer license. ADAS calibration capability is strongly recommended. |

| Colorado | CO Secretary of State | Business Entity Registration | CO SOS Website | $50 – $100 | No specific state-level auto glass license. A state business registration is the first step. |

| Connecticut | CT Department of Motor Vehicles | Motor Vehicle Repair Shop License | CT DMV Website | $200 | Auto glass businesses require Motor Vehicle Repair Shop license under CT DMV regulations |

| Delaware | DE Division of Revenue | General Business License | Delaware One Stop | $75 | A general state business license is required; no specific glass classification. |

| Florida | FL Dept. of Business & Professional Regulation / Local Counties | General Business License | FL DBPR / Local Govt. Sites | Varies by Locale | No specific state glass permit; a local county/city business license is required. Mobile operators must carry proof of insurance. |

| Georgia | GA Secretary of State | Business Entity Registration | GA SOS Online | $100 – $150 | No specific auto glass installer license at the state level. General business formation is required. |

| Hawaii | HI Dept. of Taxation | General Excise Tax (GET) License | Hawaii Tax Online | $20 + GET | No specific glass license; the GET license is required to operate any business. |

| Idaho | ID Secretary of State | Business Entity Registration | ID SOS Website | $100 – $120 | No specific state license for auto glass; business must be registered with the state. |

| Illinois | IL Dept. of Revenue | Retailer’s Occupation Tax Permit | IL MyTax Website | $0 | No specific auto glass “permit”; a tax registration number is required to collect sales tax. |

| Indiana | IN Secretary of State | Business Entity Registration | IN SOS Website | $90 – $150 | No specific glass license; the primary requirement is registering your business entity. |

| Iowa | IA Secretary of State | Business Entity Registration | IA SOS Website | $50 – $100 | No state-specific glazing license for auto glass; standard business registration applies. |

| Kansas | KS Secretary of State | Business Entity Registration | KS SOS Website | $85 – $160 | No specific auto glass license. Registration with the Secretary of State is the key step. |

| Kentucky | Local City/County Governments | General/Local Contractor License | Check Local Municipal Sites | Varies | No state glazing license; licensing is handled at the city/county level. A local contractor license may be required. |

| Louisiana | LA State Licensing Board for Contractors | Commercial Contractor License | LA SLBC Website | $100+ | A state license applies mainly to structural/commercial glazing. Auto glass may not require it unless part of larger contracts. |

| Maine | ME Dept. of Professional & Financial Regulation | Glazing Contractor License | ME PFR Website | $150 | Likely required. A state license is needed for glazing contractors, which includes auto glass. |

| Maryland | MD Motor Vehicle Administration | Automotive Repair Facility License | MD MVA Website | $300 | Auto glass repair falls under automotive repair facility regulations |

| Massachusetts | MA Division of Standards | Motor Vehicle Repair Shop License | MA Government Website | $150 | License required for all motor vehicle repair shops including auto glass |

| Michigan | MI Dept. of Licensing & Regulatory Affairs | Automotive Repair Facility License | MI LARA Website | $120 | Auto glass businesses are regulated under the general Automotive Repair Facility license, not a specific glazing license. |

| Minnesota | MN Dept. of Labor & Industry | Residential Glazing Contractor | MN DLI Website | $200 | License required for residential work; commercial may have exemptions. Check with the department. |

| Mississippi | MS State Board of Contractors | Glazing Contractor License | MS Board Website | $300 | Yes, a specific license is required. Requires passing business and trade law exams. |

| Missouri | MO Secretary of State | Business Entity Registration | MO SOS Website | $50 – $105 | No specific state license for auto glass; the main step is business entity registration. |

| Montana | MT Dept. of Labor & Industry | Glazing Contractor License | MT DLI Website | $200 | Likely required for glazing projects, which includes auto glass installation and repair. |

| Nebraska | NE Dept. of Labor | Glazing Contractor License | NE DOL Website | $175 | A state license is required for glazing contractors operating in Nebraska. |

| Nevada | NV State Contractors Board | Glazing Contractor (C-21) | NV SCB Website | $600 + Bond | Yes, a specific license is required. Involves a rigorous application, exam, and surety bond. |

| New Hampshire | NH Secretary of State | Business Entity Registration | NH SOS Website | $100 | No specific glass license; registering your business with the state is mandatory. |

| New York | NY Department of Motor Vehicles | Motor Vehicle Repair Shop Registration | NY DMV Website | $100 | Registration required for all motor vehicle repair shops |

| New Mexico | NM Regulation & Licensing Dept. | Glazing Contractor License | NM RLD Website | $300 | Yes, a specific license is required. Requires proof of experience and passing a trade exam. |

| North Carolina | NC Licensing Board for General Contractors | Glazing Contractor License | NC License Board | $225 | Likely required. A state license is needed for glazing contractors above a certain job value. |

| North Dakota | ND Secretary of State | Business Entity Registration | ND SOS Website | $125 | No specific state-level license for auto glass businesses. |

| Ohio | Local Municipalities | Contractor Registration | Check Local City Websites | Varies | No statewide glazing license; business registration and local contractor licensing may apply. |

| Oklahoma | OK Construction Industries Board | Glazing Contractor License | OK CIB Website | $185 | Yes, a specific license is required. Requires passing a trade exam. |

| Oregon | OR Construction Contractors Board | Glazing Contractor License | OR CCB Website | $350 | Yes, a specific license is required. Requires passing a business and trade exam. |

| Pennsylvania | PA Department of Transportation | Motor Vehicle Repair Shop Registration | PA DOT Website | $100 | Auto glass businesses must register as motor vehicle repair facilities |

| Rhode Island | RI Contractors’ Registration & Licensing Board | Glazing Contractor Registration | RI CRLB Website | $200 | Registration is mandatory for all glazing contractors, which encompasses auto glass work. |

| South Carolina | SC Contractor’s Licensing Board | Glazing Contractor License | SC LLR Website | $220 | Yes, a specific license is required. Requires passing business and trade law exams. |

| South Dakota | SD Secretary of State | Business Entity Registration | SD SOS Website | $150 | No specific auto glass license; business must be registered with the Secretary of State. |

| Tennessee | TN Board for Licensing Contractors | Glazing Contractor License | TN Board Website | $250 | Yes, a specific license is required. Requires passing a trade exam and providing proof of experience. |

| Texas | Texas Dept. of Licensing & Regulation / Localities | General Business/Contractor Registration | TDLR / Local Govt. Sites | Varies | No state-level glazing license for auto glass. A general business registration and local permits are required. Surety bonds may be required by locality. |

| Utah | UT Division of Occupational and Professional Licensing | Glazing Contractor License | UT DOPL Website | $250 | Yes, a specific license is required. Requires passing a trade exam. |

| Vermont | VT Secretary of State | Business Entity Registration | VT SOS Website | $125 | No specific glass license; the primary requirement is state business registration. |

| Virginia | VA Dept. of Professional & Occupational Regulation | Class A/B/C Contractor License | VA DPOR Website | $185 | A glazing classification is optional and applies mainly to structural work. Auto glass shops typically need a general business license. |

| Washington | WA Dept. of Licensing | Glazing Contractor License | WA DOL Website | $400 | Yes, a specific license is required. Requires passing a trade exam and providing proof of experience. |

| West Virginia | WV State Tax Department | Business Registration Certificate | WV Tax Website | $30 | No specific auto glass license; a business registration certificate is required. |

| Wisconsin | WI Dept. of Safety & Professional Services | Glazing Contractor License | WI DSPS Website | $150 | A state license is required for glazing contractors, which includes auto glass work. |

| Wyoming | WY Secretary of State | Business Entity Registration | WY SOS Website | $100 | No specific auto glass license; registering your business entity with the state is required. |

| New Jersey | NJ Motor Vehicle Commission | Automotive Repair Facility License | NJ MVC Website | $200 | Auto glass repair regulated under general automotive repair laws |

Auto Glass Business Startup Costs & Financial Requirements

Many aspiring business owners fail to budget for the full spectrum of financial requirements, leading to cash flow problems before the first job is even completed. Beyond the obvious licensing fees by state, you must account for bonds, understanding state glass insurance laws, and equipment financing. Underestimating these startup costs is a top reason many new auto glass businesses struggle in their first year. Industry experts and entrepreneurs often recommend maintaining a 60–90 day cash buffer.

Surety Bond Requirements by State

A surety bond is a three-party agreement that guarantees your business will comply with state laws. It protects consumers from fraudulent or shoddy work — serving as a financial guarantee for your customers, not insurance for you. How much is a surety bond for a glass shop? Costs vary by state requirement and your personal credit, but typically range from $500 to $2,500 per year, calculated as a percentage of the total bond amount (e.g., 1-5%). For example, a $10,000 bond might cost you $100-$500 annually.

Insurance Requirements Breakdown

Insurance requirements are non-negotiable. At a minimum, you need General Liability insurance (often $1-2 million coverage). You will also need Garagekeeper’s Liability insurance to protect customers’ vehicles while in your care. One user on a forum cited paying around $60/month for their $1M liability policy. Worker’s Compensation insurance is mandatory if you have employees. Without proof of insurance, you cannot get licensed or become part of insurance Direct Repair Programs (DRPs). These insurance requirements form a critical part of the broader auto glass shop business regulations that every shop owner must understand.

License Fee Breakdown: A State-by-State Cost Analysis

The application fees are just one part of the cost. As seen in the directory, state fees can range from under $100 to over $500. However, this does not include local city or county business license fees, which can add hundreds more. When calculating your total startup cost, you must aggregate the state fee, local fees, bond cost, and insurance premiums to get a true picture.

Equipment Financing Options for ADAS Calibration Tools

Modern vehicles require Advanced Driver-Assistance Systems (ADAS) calibration after a windshield replacement. Proper ADAS calibration procedures ensure vehicle safety systems function correctly. The equipment for this can cost $20,000 to $100,000+.

While not always mandated for the initial license, lacking this capability severely limits your business viability. Many owners use equipment financing loans, lease the technology, or partner with a third-party calibration service to manage this compliance cost by state and technological demand.

Deep Dives into Major State Licensing Processes

While the directory provides the starting point, the application process itself can be daunting. Here, we break down the step-by-step procedures for three major states, incorporating common pitfalls discussed by those who have navigated these “bureaucratic nightmares.” Understanding the licensing application process in detail can save you months of delays.

California BAR Registration: A Step-by-Step Process

The California BAR registration is known for its strictness. The process involves: 1) Forming your business entity (LLC or Corp.), 2) Obtaining your proof of insurance and surety bond, 3) Completing the BAR’s application packet in its entirety, and 4) Passing a site inspection.

- Application Timeline: Expect 4-8 weeks for processing, assuming no errors.

- Common Rejection Reasons: The #1 reason is incomplete supporting documents. The BAR requires everything at once: LLC papers, insurance certificates, and bond proof. Submitting a personal check when a cashier’s check is required also causes instant rejection.

- Renewal Requirements: The license must be renewed annually, with ongoing fees and continued proof of insurance and bond.

Florida FDACS Mobile Glass Permit: A Step-by-Step Process

To register with Florida FDACS, you must apply for the specific Motor Vehicle Glass Replacement and Repair Permit. The steps are: 1) Complete the application form, 2) Provide proof of general liability insurance, and 3) Submit the required fee.

- Application Timeline: Processing can take 2-4 weeks.

- Common Rejection Reasons: A frequent point of confusion is whether the permit is per-business or per-technician. The FDACS permit is for the business entity itself. Failing to provide the correct insurance limits is another common error.

- Renewal Requirements: This permit renews annually, and you must maintain continuous insurance coverage.

Texas Glazing Contractor License: A Step-by-Step Process

The Texas glazing contractor license is a more traditional trade license. The steps to get this auto glass license are: 1) Pass the glazing contractor trade exam, 2) Pass the business management exam, 3) Submit your application with proof of experience, and 4) Provide proof of a surety bond.

- Application Timeline: The entire process, from exam to licensure, can take 2-3 months.

- Common Rejection Reasons: Applications are often denied due to insufficient proof of hands-on experience in the glazing trade or an incomplete surety bond form.

- Renewal Requirements: The license is renewed every two years, requiring continuing education hours and payment of a renewal fee.

Regulatory & Operational Compliance Guide

Getting your license is just the beginning. Maintaining ongoing compliance is what keeps your business open and protects you from fines and lawsuits. This involves a web of regulations beyond the initial license, covering everything from your waste disposal to your advertising claims.

Environmental Compliance: Glass Waste Disposal & Hazardous Material Handling

You cannot simply toss old windshields in a landfill. Laminated glass is often regulated as a special waste. Environmental compliance involves partnering with a certified recycling facility and maintaining detailed records of hazardous material handling — including the proper disposal of urethane adhesives. Failure to do so can result in significant EPA or state-level fines.

Zoning Laws & Local Permits for Home-Based & Mobile Businesses

Where you operate matters. If you run a shop, it must be in a commercially zoned area. If you operate a home-based office for a mobile service, you may need a home occupation permit. Zoning laws can also restrict where you can park a mobile service vehicle. Always check with your local city and county planning department—this is a critical step many mobile operators miss.

Consumer Protection Rules: Invoice Requirements & State Repair Acts

Many states have specific consumer protection rules for automotive repairs. These often include mandatory auto glass warranty protections for customers. Your invoices must be clear, itemized, and include specific language about parts used (new OEM, aftermarket, or used).

Some states have “Repair Acts” that give consumers a right to a detailed estimate and require your authorization before proceeding with work. Violating these can lead to license suspension and consumer lawsuits.

Record-Keeping & Documentation Requirements

You must maintain detailed record-keeping for every job. This includes customer information, vehicle details, the parts used, and the date of service. These records must be kept for a mandated period (often 3-7 years) and be available for state inspection. This is crucial for warranty claims and liability protection.

Advertising Regulations for Auto Glass Shops

Your advertising regulations must be transparent. You cannot use deceptive offers or misrepresent your services. For example, if you advertise a “free windshield with insurance,” the fine print must be clear and conspicuous. Many states also require your license number to be displayed in all advertisements.

From Technician to Business Owner: The License Transition Guide

Making the leap from a paid technician to a business owner involves a significant shift in mindset and paperwork. Our auto glass business startup guide provides essential steps for this transition. It’s not just about technical skill; it’s about understanding business structure and legal responsibilities. This transition is frequently discussed in online forums, where technicians seek practical advice on navigating this complex change.

The first step is to formalize your business structure. Operating as a Sole Proprietorship is simple but exposes your personal assets to business liabilities. Forming an LLC (Limited Liability Company) is highly recommended as it protects your personal home and savings from business debts and lawsuits. You must then apply for all necessary local, state, and federal tax IDs. Furthermore, you must now secure the business-level licenses and permits discussed in this guide, which are separate from your personal technician certifications. Some states also have continuing education requirements for license renewal, ensuring you stay current with evolving automotive glass safety standards and technology like OEM glass certification protocols.

Common Application Mistakes & How to Avoid Denial

Seeing your application denied is costly, frustrating, and delays your business launch. Based on discussions with state agencies and real-world accounts from applicants, several avoidable errors account for the majority of application rejections. Proactively addressing these will smooth your path to approval.

- Missing Supporting Documents: This is the top reason for delay and denial. States require a complete package: business formation documents, proof of insurance, bond forms, and tax IDs. Do not submit the application until you have every single required document assembled. The California BAR, for instance, is notorious for rejecting incomplete packets.

- Incorrect Fee Payments: Sending a personal check when a cashier’s check or money order is required will get your application returned immediately. Double-check the payment method and the exact amount, including any processing fees.

- Missing ADAS Calibration Proof: While not a universal license requirement yet, more states are looking for proof of your capability to perform safe, compliant installations. Demonstrating your investment in ADAS calibration certification or partnerships can prevent questions about your technical competency.

- Failure to Meet Surety Bond or Insurance Minimums: Your application will be rejected if your bond value or insurance coverage limits do not meet the state’s minimum requirement. Have an insurance agent verify the certificates before you submit them.

- Underestimating Multi-Jurisdiction Requirements: A classic common application mistake for mobile operators is only getting the state permit and forgetting about city and county business licenses. This can result in operating illegally and voiding your state license.

Free Downloadable Auto Glass Business Startup Checklist

To ensure you miss nothing, we’ve created a comprehensive, actionable checklist based on the real-world pitfalls and requirements outlined in this article. This printable PDF incorporates all the critical steps, from business formation to post-license operational setup, complete with our “green OK stamp” for you to mark off each completed task.

Checklist Enhancements Include:

- Business Formation: EIN (Employer Identification Number) confirmation and LLC registration filing.

- Financial Preparedness: Secure surety bond acquisition and obtain proof of business insurance setup (Liability & Garagekeeper’s).

- Regulatory Compliance: Apply for environmental compliance certification and verify local zoning permits.

- Technical Capability: Plan for equipment procurement for ADAS and set up accounts with insurance claims networks (NAGS, LYNX).

- Operational Readiness: Develop a 90-day cash flow plan and prepare your record-keeping

Conclusion

Successfully launching your auto glass business hinges on navigating the complex web of auto glass business license requirements and state licensing regulations. This guide has provided the essential roadmap, from understanding surety bond and insurance requirements to securing necessary ADAS calibration certification. By using this 50-state directory and adhering to all automotive glass safety standards, you establish a foundation of compliance and professionalism. This diligence is your first critical step toward building a trusted, successful, and legally sound enterprise.

Frequently Asked Questions (FAQs)

Q: What business does not require a license?

A: Very few, and it varies by state and locality; most sole proprietorships using your own name may not need one, but you should always check with your city and state.

Q: How do I check a business license in the US?

A: Contact the Secretary of State’s office for the state where the business is located or search their online business entity database.

Q: How much does an auto glass business make?

A: A well-run shop can generate $200,000 to $500,000+ in annual revenue, with profitability heavily dependent on overhead and insurance work volume.

Q: Is doing car glass a profitable business?

A: Yes, it can be very profitable due to high demand from accidents and weather damage, especially if you secure contracts with insurance Direct Repair Programs (DRPs).

Q: How much does auto glass now pay?

A: Technicians earn $40,000-$70,000 annually, while business owners’ income is tied to profit, which can be $80,000-$150,000+ after established.

Q: What is the most profitable automotive business?

A: Specialized, high-margin services like EV battery repair, classic car restoration, and advanced ADAS calibration are among the most profitable.

Q: Is auto glass a good business?

A: Yes, it’s a recession-resistant service business with consistent demand, but it requires significant upfront investment in licensing, insurance, and ADAS equipment.

Q: How profitable is the glass industry?

A: The auto glass sector is a profitable niche with strong margins, driven by necessary repairs and the high cost of modern windshield replacements with calibration.

Q: How much does it cost to start an auto glass business?

A: Total startup costs typically range from $50,000 to $150,000, covering licensing, a vehicle, tools, insurance, bonds, and ADAS calibration equipment.

Q: Can you make money repairing windshields?

A: Yes, windshield repair is a high-margin service, but the primary revenue for most businesses comes from full replacements.

Q: How much do windshield guys make?

A: Auto glass technicians typically earn $18-$28 per hour, while business owners’ income is unlimited and based on the company’s profit.

Q: Will State Farm pay for windshield repair?

A: Yes, State Farm often covers windshield repair and replacement under comprehensive coverage, typically with a $0 deductible for repair.

Q: How much money does it take to fix a windshield?

A: A simple repair costs $50-$100, while a full windshield replacement ranges from $250 to $1,500+, with ADAS calibration adding $200-$1,000 more.

Q: Can I apply as a mobile operator only?

A: Yes, many states offer specific mobile permits, but you must also check for city and county business licenses in every area you plan to work.

Q: Are there expedited license approvals?

A: Expedited approvals are rare; the fastest path is to submit a perfectly complete application to avoid delays from requests for more information.

Q: How long does license approval take?

A: Approval can take 2-4 weeks for simple permits or 2-3 months for complex trade licenses that require exams and background checks.

Q: If my application is denied, do I get the application fee back?

A: No, application fees are non-refundable processing charges, even if your application is denied.

Q: Do I need to invest in expensive ADAS calibration equipment before I can even get licensed?

A: Not necessarily; you can outsource calibrations initially, but you must have a reliable process to ensure compliance.

Q: How much should I realistically budget for surety bonds and insurance?

A: Budget $1,000 to $4,000 for the first year to cover the surety bond premium and business insurance policies.

Q: My state’s website doesn’t mention ADAS. If I don’t do it, what’s the legal risk?

A: The legal risk is massive; you could be held liable for millions in damages if an accident occurs due to a non-calibrated system you serviced.

Q: Do I need a business license for every city I work in as a mobile operator?

A: In many states, yes; you are often required to obtain a business license in every incorporated city and county where you perform services.

Q: What’s the real difference between a business license, a glazing contractor license, and a technician certification?

A: A business license allows you to operate, a glazing contractor license permits glass work, and a technician certification validates an individual’s skill.

Q: I’m a mechanic. Does my auto repair license cover windshield work, or do I need a separate one?

A: In most states, no; auto glass work typically requires a separate glazing contractor license or a specific auto glass registration.